HTA goes global

06/10/2020 Author: root_d8k2o428

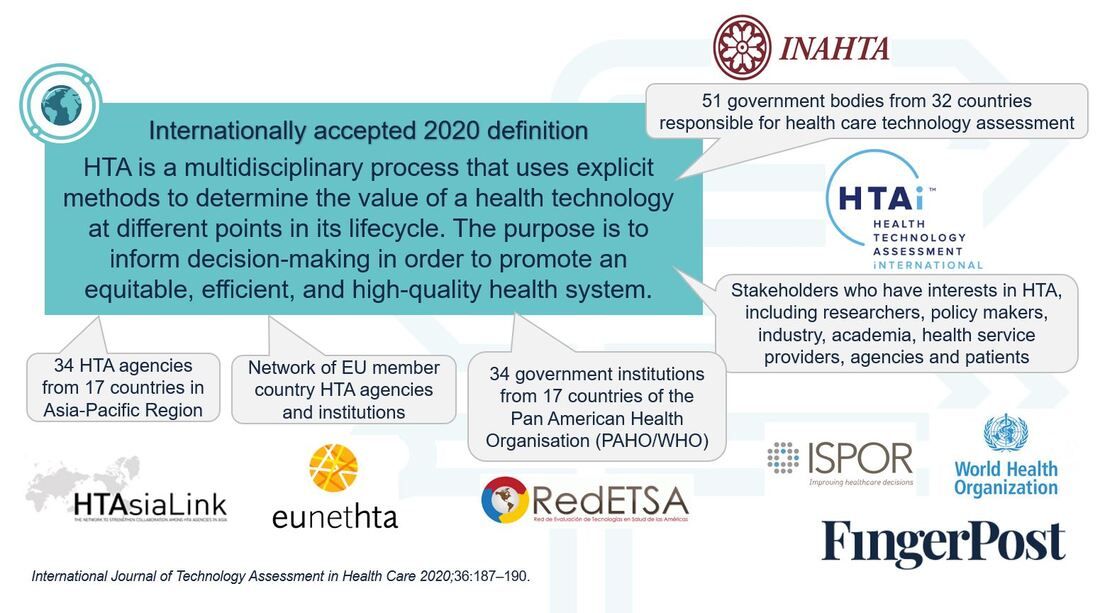

In May this year, a new definition of HTA was announced following a collaboration co-led by the International Network of Agencies for HTA (INAHTA) and HTA International (HTAi).This…

Current biosimilar initiatives in Australia and Canada

02/10/2020 Author: root_d8k2o428

Ceperaec temperi bustius, this is an external link. Nam que nistore nectemperum accullest, omnisci a doloreium sitia solupta sum et aut es qui doluptati nus et lab illa simusdam…

Current biosimilar initiatives in Australia and Canada

04/08/2020 Author: root_d8k2o428

Over the past five years, a number of ‘big brand’ biologics have gone off patent and have been replaced with biosimilars. This remains a challenge for any biologic nearing the…

June: A global snapshot of COVID-19 – Part 2

01/07/2020 Author: root_d8k2o428

At the end of April, we published a summary of the global response to COVID-19 as written by a selection of FingerPost’s Global Associates who specialise in Market Access across different…

Focus on Japan: Reimbursement decisions from January – May 2020

31/05/2020 Author: root_d8k2o428

Pricing The highlight of the first quarter of 2020 was the bi-annual revision of National Health Insurance (NHI) prices and of medical fees, announced in March and coming into effect…